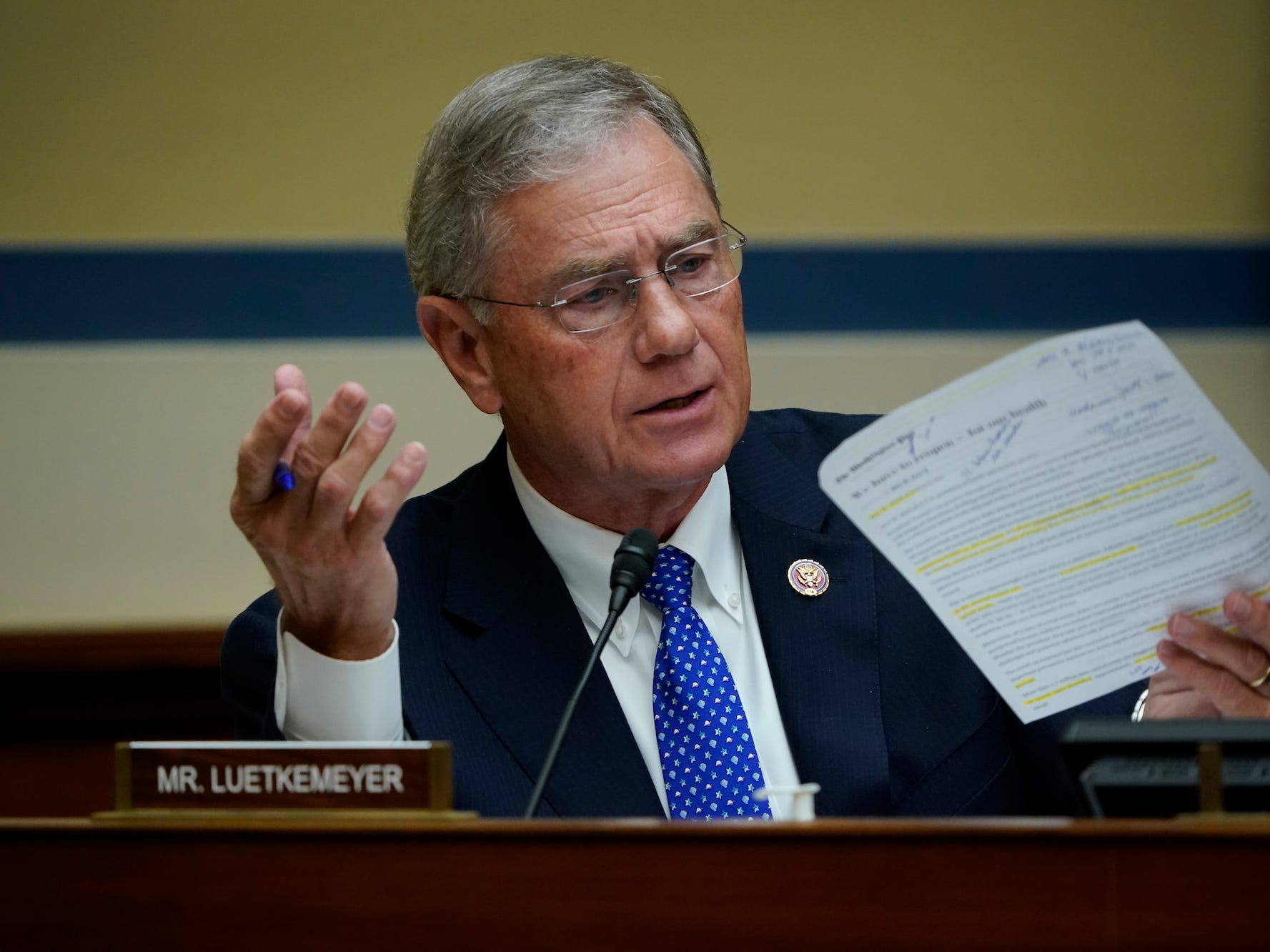

J. Scott Applewhite-Pool/Getty Images

- The House voted to extend the Paycheck Protection Program through May 31.

- The bill also allows the Small Business Administration to process loan applications through June 30.

- The 415-3 bipartisan vote may ensure small businesses won't experience a lapse in needed aid.

- See more stories on Insider's business page.

To continue providing aid to small businesses recovering from the pandemic, the House voted on Tuesday to extend the Paycheck Protection Program (PPP) by two months, ahead of its expiration on March 31.

The bill to extend the PPP had been introduced on March 11 by Small Business Committee Chair Nydia Velàzquez, Ranking Member Blaine Luetkemeyer, Rep. Carolyn Bourdeaux of Georgia, and Rep. Young Kim of California. Less than a week later, the House overwhelmingly voted by 415-3 to extend the program through May 31 to avoid a lapse of aid.

The program has provided small businesses with $700 billion of emergency loans to date, according to a press release.

-House Committee on Small Business (@HouseSmallBiz) March 17, 2021

"Based on recent economic data and the demand for PPP loans, it's clear that small businesses still need support. We are making progress in our public health fight against this virus, but this pandemic continues to impact communities across the country, and we can't let up on our efforts," Velázquez said in a statement. "By providing small businesses with two more months to apply and giving the SBA [Small Business Administration] an additional month to process applications, we will help ensure critical support isn't cut off."

Under the bill, the SBA has until June 30 - a month after the PPP ends - to continue processing loan applications, giving small businesses the chance to continue receiving aid after the Program expires.

Since it was first established under the CARES Act in March, the PPP has encountered a host of issues with loan distribution. For example, although loans within the program are intended for businesses with 500 or fewer employees, the fast-food chain Shake Shack received a $10 million loan, which it later returned.

And recently, the Office of the Inspector General found that the PPP distributed more than one loan to over 4,000 borrowers due to flaws in the SBA's controls.

However, despite the flaws, small businesses have not yet recovered from financial hits the pandemic brought on, emphasizing the need for a PPP extension. In President Joe Biden's American Rescue Plan he signed on March 11, $50 billion was set aside for small businesses, including $7.25 billion specifically for the PPP.

The bill now heads to the Senate, where it may be passed before members leave Washington in mid-April.

"As America begins to open up for business and vaccines become more widely distributed across the country, we must provide targeted relief for small businesses that need it most," Luetkemeyer said in a statement. "This bipartisan legislation provides a commonsense extension to the Paycheck Protection Program and the tools for Main Street USA to contribute to their local economies once again."